LVR Restrictions

This week we saw the Reserve Bank lower the loan to-value ratio (LVR) retractions that have been in place for the past 12 months or so. This will have a positive impact for first home buyers who provided can still meet the banks lending criteria they may now be able to jump on the property ladder.

NZ Herald article

Stuff article

Did the LVR save NZ Housing Market from Covid-19 collapse? see the following OneRoof article.

“Removing LVR restrictions now supports financial stability by removing one potential obstacle to the flow of credit in the economy, helping to soften the downturn.”

So what are LVR Restrictions?

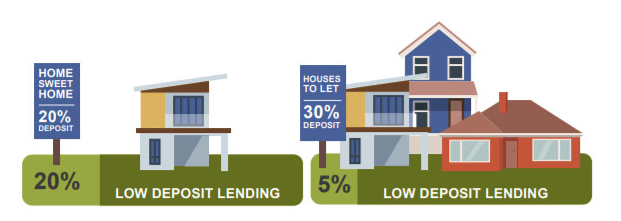

A loan-to-value ratio (LVR) is a measure of how much a bank lends against mortgaged property, compared to the value of that property. Borrowers with LVRs of more than 80 percent (less than 20 percent deposit) are often stretching their financial resources.

They are more vulnerable to an economic or financial shock, such as a recession or an increase in interest rates. When we talk about high-LVR (low-deposit) lending, we are generally referring to someone with less than a 20 percent deposit – or an LVR ratio of greater than 80 percent. For investors purchasing property secured with a mortgage, deposits of less than 30 percent (LVR of greater than 70 percent) are considered high-LVR.

These restrictions provide a buffer in the face of a sharp housing downturn, which would particularly affect highly-indebted home owners and investors.

Wanting to know how the LVR restrictions might now help you purchasing your next home? give me a call.

I would also highly recommend that you speak with a Mortgage Advisor as they will be able to help, and whats great is they work independent of the banks to get you the very best possible deal. A couple of really great people and Companies that I would recommend are as follows:

Wayne Lawrie – The Mortgage Studio 027 470 9990

Suzanne Isherwood – Mortgage Express 0274789995